[ad_1]

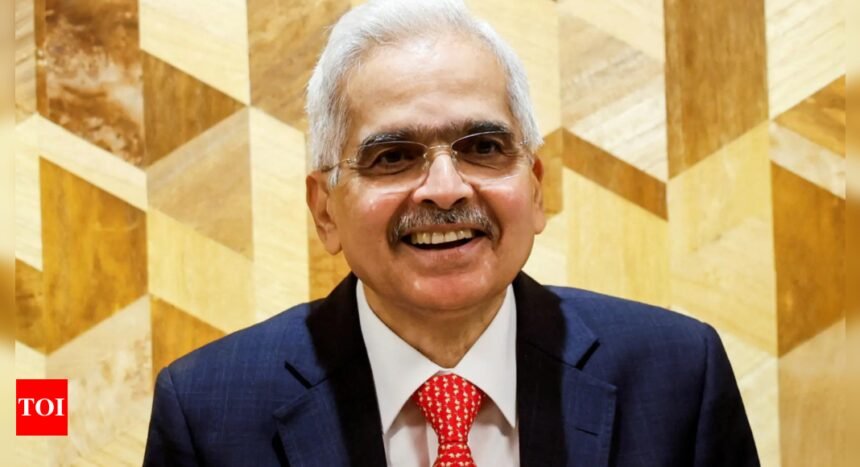

MUMBAI: One of the biggest validations for RBI governor Shaktikanta Das came towards the end of his tenure. Both the commerce and finance ministers criticised RBI’s decision to maintain higher interest rates for an extended period.

Their statements – far from being laudatory – highlighted RBI’s robustness as an institution in being capable of resisting govt excesses. The ministers’ criticism of Das dispels most of the concerns raised when he took charge about RBI’s ability to take an independent stand.

In 2018, Das had succeeded Urjit Patel, whose tumultuous and transformative tenure was marked by demonetisation, a new monetary policy framework, bankruptcy reforms, and lending restrictions on public sector banks. Back then, Patel had resigned amid tensions between RBI and the finance ministry, with govt seeking greater control over governance of the central bank. Being govt’s representative for demonetisation and succeeding Patel, Das was initially seen as aligned with govt.

He began his tenure by rebuilding bridges within RBI and adopting a consultative approach. By ensuring clear communication across multiple channels, including speeches, interactions with bankers as well as research publications, he left no room for confusion. His speeches often ended with a quote from Mahatma Gandhi, while his policy statements frequently referenced “Arjuna’s eye” – symbolising RBI’s unwavering focus on inflation.

In regulation, RBI adopted a strategy of pre-emptive strikes through business restrictions rather than just warnings. Major institutions such as HDFC Bank, Bajaj Finance, and Bank of Baroda faced business restrictions for transgressions – a strategy that seems to have yielded results. Under Das, RBI also controlled financial markets with an iron hand, leading the IMF to classify India’s FX market as a “managed float” rather than market-determined.

Das’s strength lies in implementing key reforms subtly, as seen in his handling of the largest cooperative bank collapse and the failure of Yes Bank a year into his tenure. Breaking from tradition, where public sector banks bailed out failed entities using taxpayer money, he facilitated private-sector-led rescue packages, avoiding any burden on public funds.

During the pandemic, while global regulators pushed for freezing borrower liabilities, RBI offered support worth several lakh crore rupees as soft loans with a sunset clause, avoiding outright giveaways. Das’s effective coordination between RBI’s monetary policy and the Centre’s fiscal policy played a key role.

In many areas, the perception of the Modi govt is that it pushes reforms aggressively, aided by its parliamentary majority. While this works well for infrastructure projects, banking and finance require a different approach. Acting too forcefully can undermine reforms’ successful implementation. In a country where reforms have historically been implemented in times of crisis and through stealth, Das’s method of persuasive diplomacy and strategic subtlety stands out.

[ad_2]

Source link