[ad_1]

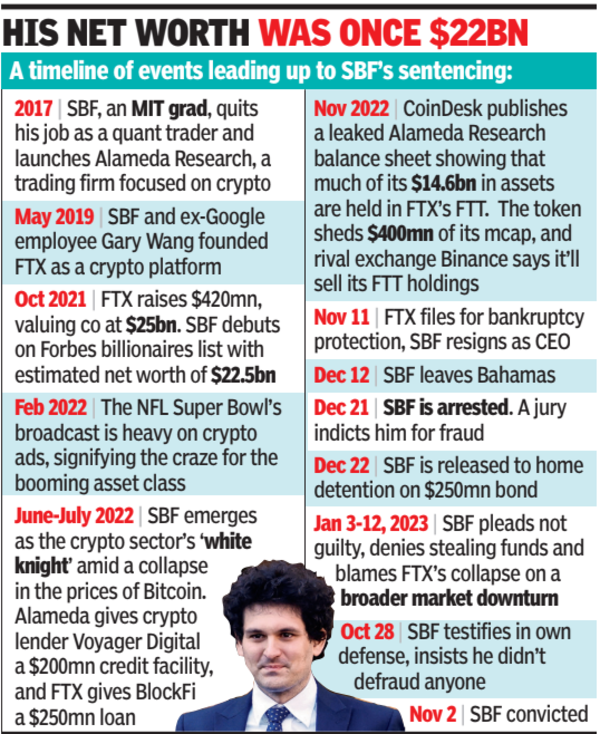

But the stunning rise of Sam Bankman-Fried, known as SBF, and his FTX platform would be matched by an equally spectacular fall when it was revealed that billions of dollars of clients’ funds had been moved and spent without their consent.

After a jury in 2023 found him guilty of seven counts, a federal judge in New York sentenced Bankman-Fried on Thursday to 25 years for leading the fraudulent scheme.

Before it all came crashing down, the native Californian had amassed a fortune at one point estimated to be worth $26 billion. “Save for Mark Zuckerberg, no one in history has ever gotten so rich so young,” read a headline in Forbes, which put Bankman-Fried on its cover in Oct 2021.

In the span of a few months, the Massachusetts Institute of Technology graduate with a degree in physics had taken the startup he co-founded in 2019 and built it up into the world’s second largest crypto exchange platform.

He quickly became more than just a young entrepreneur, fashioning himself as an ambassador of crypto and making his first appearance in Congress in Dec 2021, testifying before lawmakers on the then-novel form of currency. The public would come to know a seemingly oddball whizkid with a mop of curly dark hair who, when not suited up for appearances on Capitol Hill, wore shorts and a T-shirt.

The son of two Stanford professors, Bankman-Fried ventured outside the world of cryptocurrencies, making donations to US politicians and persuading celebrities like American football star Tom Brady or basketball player Stephen Curry to pitch FTX – endorsements for which they were richly rewarded.

SBF, 32, would charm US lawmakers with his straight talk and vision of crypto’s future, including recommendations for an extensive regulatory regime – a position at odds with many in the sector. He devised project after project, from a platform for people to make donations in cryptocurrency to Ukraine to a market for financial derivative products that stepped on the toes of Wall Street.

A vegan, Bankman-Fried said he believed in the concept of effective altruism – finding the best way to help other people, in particular by donating all or part of one’s wealth to charity rather than, say, volunteering at a soup kitchen.

When the cryptocurrency world lurched into crisis in the spring of 2022, Bankman-Fried billed himself as a saviour, buying the troubled platform BlockFi, and shares in another company Voyager that was in trouble. “We take our duty seriously to protect the digital asset ecosystem and its customers,” he tweeted at the time, as some people were comparing him – barely 30 years old then – to the legendary investing guru Warren Buffett. But behind his reassurances, SBF was walking a financial high wire, as was revealed later in court documents and testimony. agencies

[ad_2]

Source link