[ad_1]

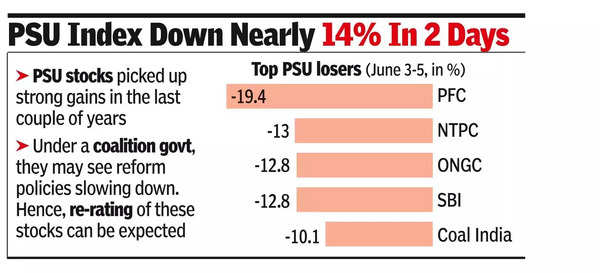

Leading stocks like SBI, Coal India, NTPC, ONGC and PFC have lost between 10% and 20% in just two sessions. This is because investors feel that under the new govt, which will greatly depend on its allies, PSU-oriented reform policies may slow down, leading to a derating of these stocks.As a result, BSE’s PSU index is now down nearly 14% in two days.

A report by Elara Capital pointed out that PSUs in the capital goods sector have seen a sharp re-rating in their multiples in the past year, driven by asharp increase in order books and elevated profitability and returns. BSE’s PSU index has yielded a return of 121% since the beginning of 2023.

The outperformance came on the back of good financial and operational performance, combined with substantial govt support. This, in turn, has led to some over-valuation for these stocks, brokers said.

That could now be corrected. “(Sectors) with over-heated valuations and recent sharp outperformance like industrials, railways, defence, and PSUs may see more moderation in valuations before they become attractive again from the risk-reward perspective,” a report by Motilal Oswal Financial Services noted.

Another worry for inves tors is if divestment or privatisation of PSUs would slow down or stall. “PSU privatisation, which has some political ramifications, could also see some delay, but we do not see the entire process getting derailed,” the report by Elara Capital noted. Investors would also closely watch if govt further consolidates PSU banks. On the positive side, the New Public Sector Enterprise Policy of Feb 2021 had categorised several sectors as strategic with the intent to retain one or more PSUs in strategic sectors, areport by Kotak Institutional Equities pointed out.

[ad_2]

Source link