[ad_1]

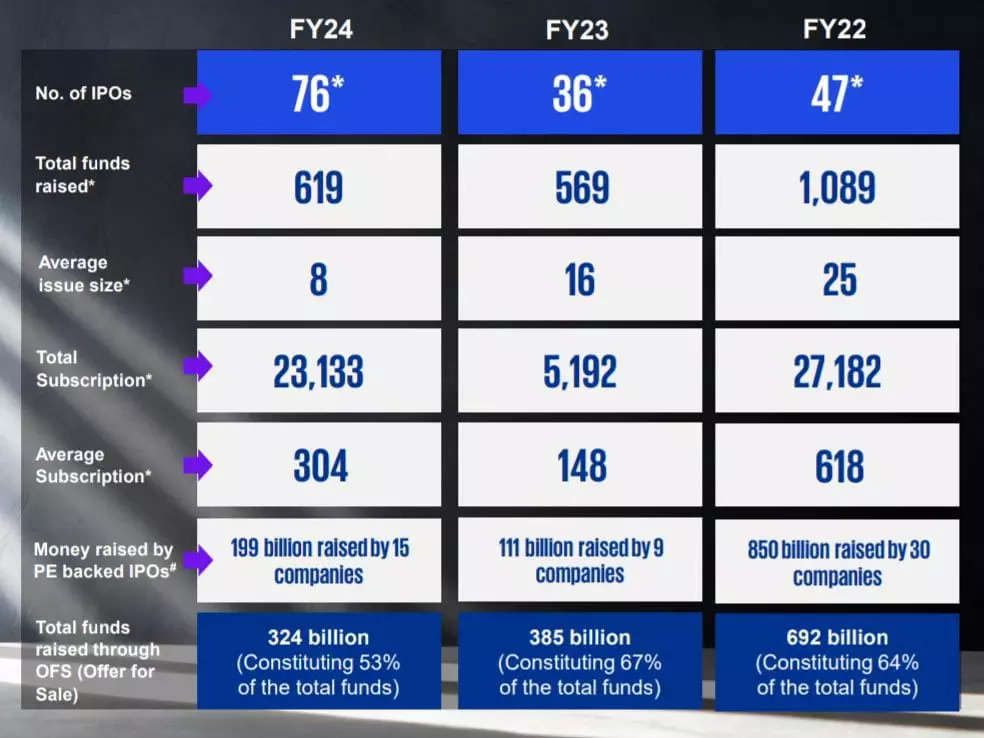

FY24 marked a significant uptick in mainboard IPOs, with 76 listings— the highest since FY17. This surge reflects a notable 111 per cent increase from the 36 listings in FY23 and a substantial 62 per cent rise from the 47 listings in FY22, revealed a latest report by KPMG India.

A total of USD 619 billion have been raised 76 IPOs in FY24, with an average issue size of USD 8 billion. Total funds raised through OFS (offer for sale) in FY24 stands at USD 324 billion while money raised by PE backed IPOs stands at USD 199 billion, by 15 companies.

Contrary to this, in FY23, a total of USD 569 billion was raised through 36 IPOs with an average issue size of USD 16 billion. Total funds raised through OFS (offer for sale) in FY23 stood at USD 385 billion while money raised by PE backed IPOs stood at USD 111 billion, by 9 companies, said the report.

This indicates that while the number of IPOs have jumped by twice the number recorded in the previous financial year, the average issue size has halved and there isn’t much difference in the total funds raises yoy.

Additionally, it is to note that in the final quarter of FY24, there were 21 mainboard IPOs, a notable increase from mere 2 observed during the corresponding period in FY23, the report added.

FY24 witnessed a diverse range of companies from finance and pharma to cables and IT launching IPOs, driven by greater market demand, liquidity, and optimism. In FY24, Financial Services raised a whopping Rs 97 billion with 10 IPOs.

ALSO READ: FY24 had most IPO listings, ranked 3rd highest in issue size: Report

Listing Performance & Subscription

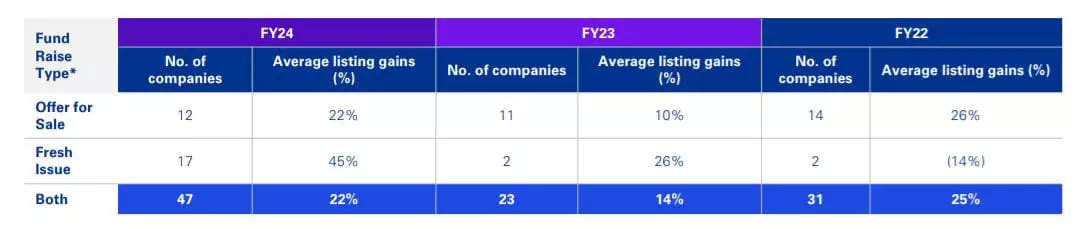

76 IPO listings registered an average listing gain of 29 per cent, compared to a lukewarm listing day performance in FY23 with average returns of 12 per cent. FY22 also experienced an average gain of 25 per cent.

While the 76 IPOs in FY24 attracted a significant oversubscription of 50 times, the average oversubscription for FY23 and FY22 was 15 and 52 times, respectively. Further, FY24 witnessed a remarkable subscription of Rs 23,133 billion against the funds raised for Rs 619 billion, highlighted the report.

In FY24, the Qualified Institutional Buyers (QIB) category experienced an average oversubscription rate of 81 times witnessing a surge in IPO activity. The average oversubscription rate stood at 31 times in FY23, which represents a decrease from the average oversubscription rate of 57 times observed in FY22.

Furthermore, the number of listings subscribed to more than 100 times in FY24 surged to 31, a significant increase from just 2 in FY23 and 6 in FY22 in the QIB category.

Retail investor participation surged in FY24, driving IPO average retail oversubscription to 30 times, significantly exceeding FY23’s 7 times and even FY22’s 14 times, the report added.

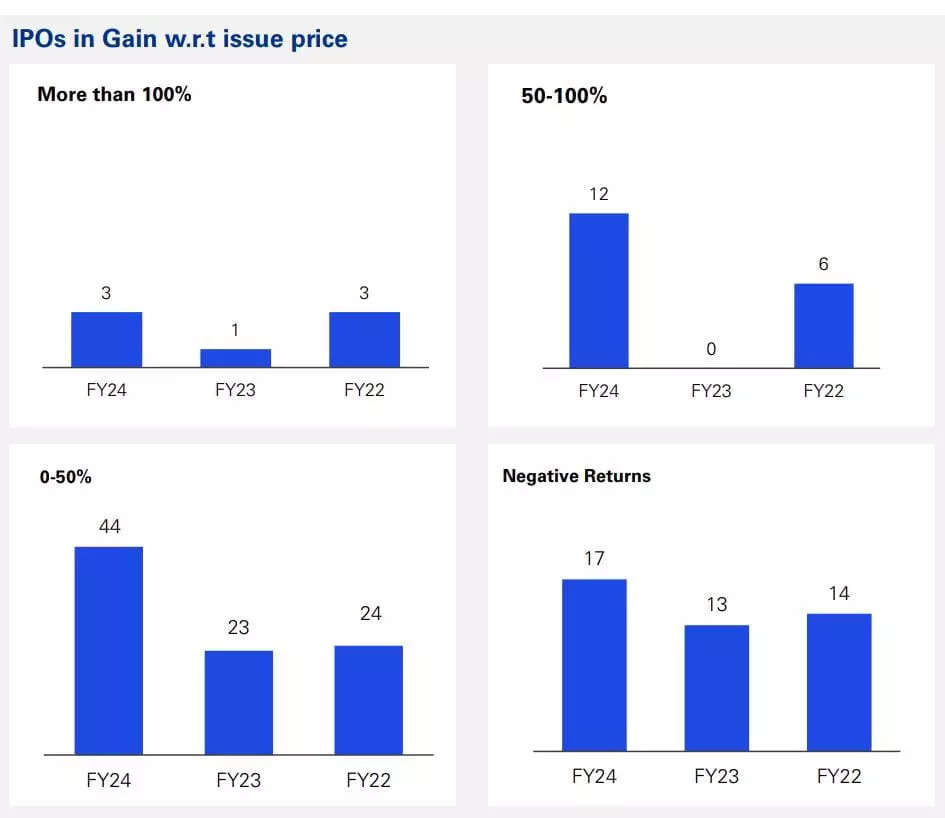

About 15 companies gave more than 50 per cent returns, and 17 companies gave negative returns in FY24.

ALSO READ: Unicorn minting slows down in India, IPOs become attractive: Report

Types of Funds raised

The number of companies with an IPO consisting only of fresh issue increased significantly from mere 2 to 17 in FY24. When more IPOs consist only of fresh issues, it indicates that companies are prioritizing raising new capital over providing an exit for existing shareholders, revealed the report.

This trend suggests a focus on funding growth, expansion projects, or strengthening financial health, rather than facilitating liquidity for current investors. It reflects a market environment where companies see opportunities for investment and development.

Contrary to this, offer for sale issues allows existing shareholders to sell their shares, which doesn’t contribute new capital to the company’s coffers.

The proportion of funds raised through offer for sale (OFS) by promoters and promoter groups decreased in FY24 as compared to FY23. This trend could indicate that there is a preference among companies to issue new shares rather than monetize their existing stakes to raise funds.

About Rs 324 billion (53 per cent) were raised through the OFS route in FY24 as compared with Rs 283 billion (47 per cent) worth of fresh issuances, the report added.

Use of Funds

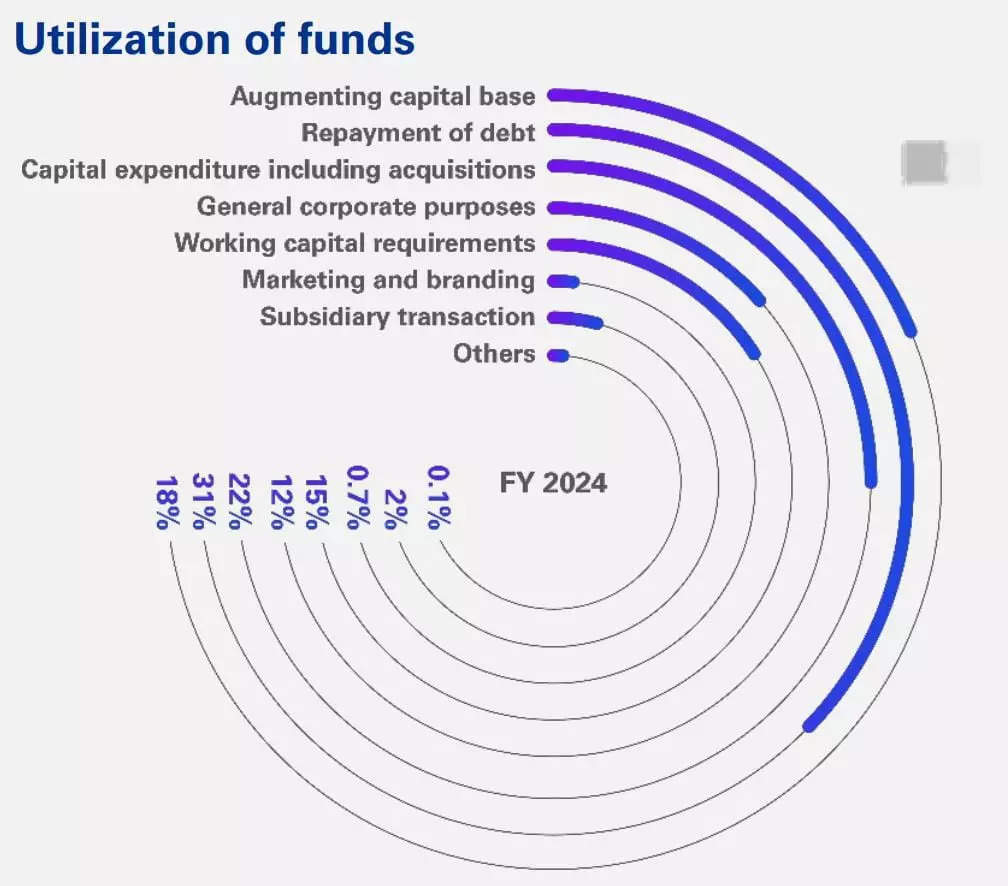

The funds generated from the fresh issuance are likely to stimulate a capex cycle as India Inc. presses the pedal on enhancing capacities to cater to robust demand and in turn contribute to employment and returns to all factors of production, the report highlighted.

However, in the case of OFS, promoters are selling their shares to reduce their stake in the listed company and reap the benefits of value unlocking.

In FY24, most of the funds raised were allocated towards debt repayment and capital expenditure, indicating a trend towards debt management. Most of the funds in FY23 were utilized for capital expenditures including acquisitions depicting growth plans of businesses due to optimism set by India’s economic recovery, it added.

[ad_2]

Source link