[ad_1]

As the world’s fifth largest economy, set to become third largest by decade’s end, India is on a high-growth trajectory, supported by favourable government policies, stronger banks, robust capital markets and a young population.

Core sectors and various ancillary and consumer industries will benefit from this even as high funding costs, higher tax rates, political instability and sluggish demand recovery remain significant challenges, experts said.

After years of balance sheet repair and consolidation, domestic Indian companies are poised for growth.

The domestic market holds immense growth potential, particularly in sectors such as consumer products, ecommerce, healthcare, pharmaceuticals, technology and manufacturing, said KR Sekar, partner and leader at Deloitte India.

The FY17 Economic Survey attributed lack of investment growth to ‘festering twin balance sheet problem’ – specifically, over-leveraged companies and banks burdened with bad loans.

The debt-to-equity ratio of 76 non-financial companies in the NSE 100 index increased from 0.8 in FY12 to 1 in FY15. On the other hand, banks were also in a dire situation. Non-performing assets of banks rose from 4% in 2014 to over 11% by 2018.

This situation made corporates realise the need for balance sheet repair to survive. A combination of asset selloffs by leveraged firms, improved cash flows of minerals-based companies, and measures by the RBI and the government to expedite the resolution of stressed assets has gradually begun to show results.

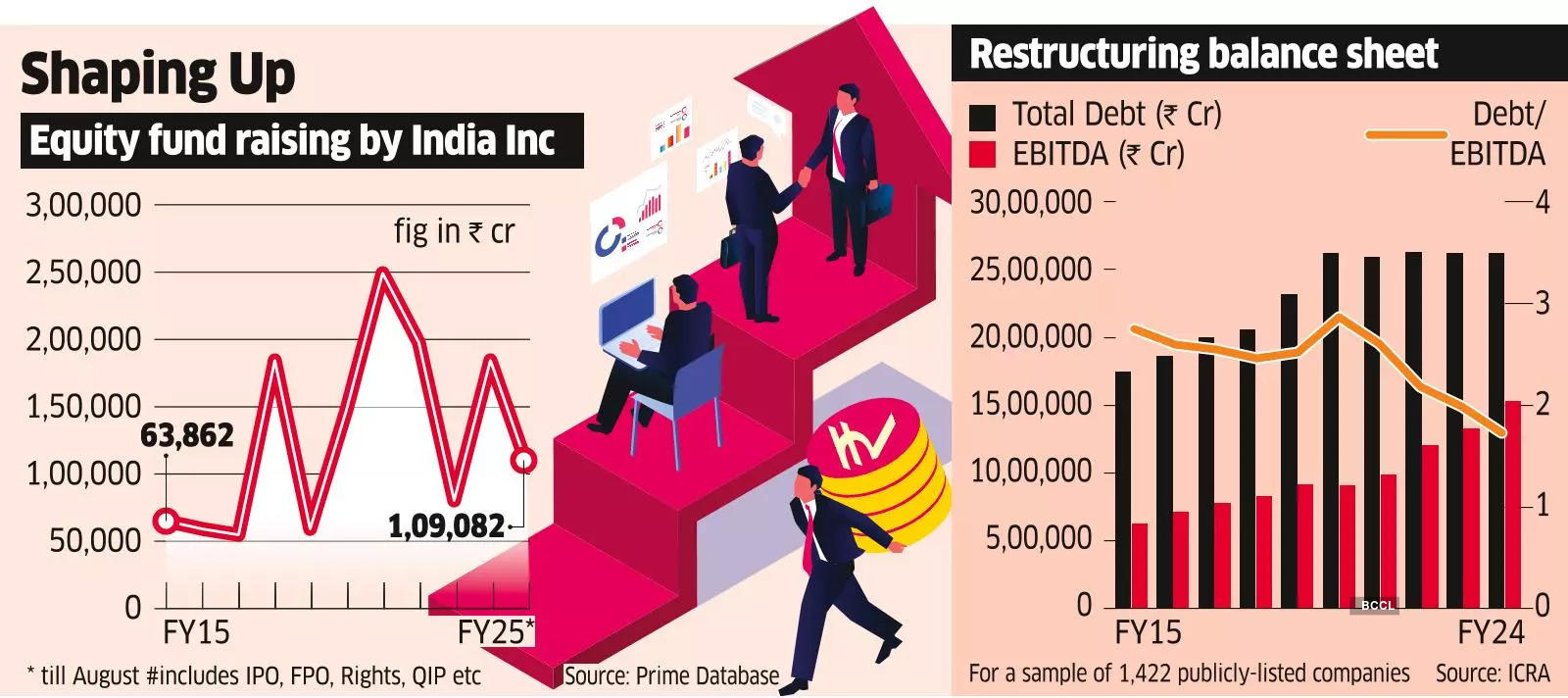

Between FY15 and FY24, while the total debt of top 1,500 listed firms grew at a CAGR of 5%, their operating profits (Ebitda) grew at a CAGR of 10%, according to data compiled by ratings agency ICRA. Consequently, the total debt-to-Ebitda ratio improved to 1.7x as of March 31, 2024, from 2.8x as of March 31, 2015. Between FY15 and FY24, the gross block of the top 1,500 listed companies grew by a multiple of 2x, while total debt expanded by a lesser degree of 1.5x.

“Various data points for the last decade indicated that corporate India has been more prudent in incurring debt-funded capex,” said Jitin Makkar, head of credit policy at ICRA. “In effect, the industry has not only been slow to expand capacity over the past few years but has also chosen to be more conservative in using debt to fund such capex.”

Government-led Initiatives

Among the various policies to aid domestic industry, the ones that have seen the highest impact include ‘Make in India‘ initiative, production-linked incentive (PLI) scheme and Insolvency and Bankruptcy Code (IBC). “The stability of the government, reduction in corporate taxes, PLI schemes for various sectors, and initiatives like ‘ease of doing business’ and ‘Make in India’ have boosted confidence in Indian corporates to invest and expand,” Deloitte’s Sekar said.

Unveiled a decade ago, the ‘Make In India’ programme aims to foster local manufacturing and make the country an export hub. Hitachi, Fiat, Apple and Google’s investments in the country are some of the examples of the initiative’s success.

Also aimed at incentivising production, the PLI scheme has an outlay of nearly ₹2 lakh crore.

The IBC, introduced in 2016, seeks to improve the credit culture of the country and tackle bad loans by resolving insolvency matters in a time-bound manner.

Between FY17 and FY21, the government infused over ₹3 lakh crore to strengthen public sector banks.

Capital MKTS: Growth Catalyst

Capital market regulator Sebi has played a pivotal role in transforming corporate governance and disclosure standards among Indian enterprises over the last decade. By implementing stringent regulations and enforcing compliance, the watchdog has ensured greater transparency and accountability.

Initiatives such as mandating detailed quarterly disclosures, enforcing stricter insider trading norms and enhancing the requirements for related-party transactions have significantly improved corporate governance practices. These regulatory changes have not only instilled investor confidence but have also prompted corporates to adopt more ethical and transparent business practices, setting a strong foundation for sustainable growth.

As a result, when corporates grappled with the shutdown and lockdown during the Covid-19 pandemic, the Indian capital market stepped in to support them. In just two calendar years-2020 and 2021-India Inc raised ₹4.08 lakh crore through equities via public issues, qualified institutional placements, rights issues, REITs, and InvITs. From 2022 to 2024, an additional ₹3.3 lakh crore was raised. Of the ₹1.89 lakh crore raised through IPOs between 2020 and 2024, around 60% was fresh capital for companies. Even the remaining 40%, raised by promoters and investors, partially went towards repaying promoter-level debt, benefiting both banks and promoters.

In 2024 alone, promoters raised over ₹1 lakh crore by selling stakes in their companies through bulk and block deals on exchange platforms. Ample domestic liquidity, with household savings shifting from bank fixed deposits to the equity market, helped Indian corporates capitalise their balance sheets effectively.

Opportunities for Enterprises

India, known as the ‘back office of the world’ for its relatively cheaper technology and business outsourcing services, is now becoming a global manufacturing force as well.

Apart from being self-sufficient in several areas including defence, semiconductors, critical minerals and energy, especially renewable energy, the country is also becoming a manufacturing hub for global majors that are looking to reduce their dependence on China.

India is the world’s second-largest producer of steel, cement, smartphones and two-wheelers, while being the third-largest producer of passenger cars.

Persistent Challenges

High funding costs and some of the world’s highest corporate tax rates pose significant hindrances, experts said. They also cite sluggish demand recovery as a major challenge for India Inc.

According to Gautam Duggad, head of research at Motilal Oswal Financial Services, beyond operational challenges, demand recovery, especially in rural areas, and subsequent improvement in capacity utilisation are crucial. “Without these, corporate investment will falter. Growth must exceed 7.5% without compromising fiscal consolidation.”

While ease of doing business has improved over the last few decades, regulations and the process of granting clearances and licences can be made a lot easier, experts said.

A slowdown in global growth has also been a dampener for local manufacturers as they fall prey to imports within a saturated global market, experts said.

According to Sekar of Deloitte, the key areas of focus for Indian corporates include enhancing their ability to attract capital, recruiting and retaining right talent, forging global alliances and establishing robust succession plans for both ownership and business, particularly for family-run businesses.

(This article is published in partnership with Deloitte)

[ad_2]

Source link