[ad_1]

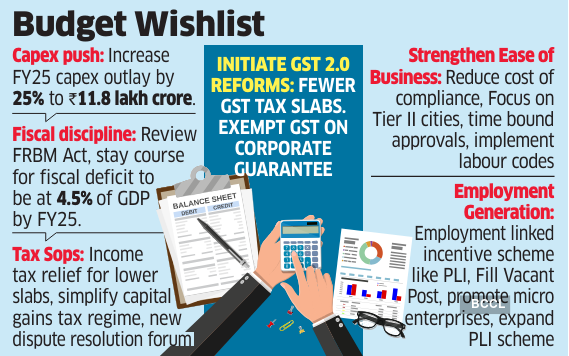

Budget 2024 expectations: Tax incentives, an increase in capital expenditure, fiscal consolidation, enhanced ease of doing business, and a stable long-term tax regime are among the key suggestions industry and financial institutions made in their pre-budget consultations with finance minister Nirmala Sitharaman on Thursday.

The Confederation of Indian Industry (CII) said its president Sanjiv Puri suggested a 25% increase in capex spending over the revised estimate of FY24 and relief in income tax to boost consumption.

CII also suggested setting up a Green Transition (Mitigation and Adaptation) Fund for which multiple sources of funding could be tapped and would facilitate the availability of capital at a lower cost, it said in a statement.

The PHD Chamber of Commerce and Industry (PHDCCI) made suggestions towards expanding the productivity-linked incentives (PLI) scheme to cover more sectors such as medicinal plants and handicrafts, and to incentivise startups, it noted in a statement. Ficci said its immediate past president Subhrakant Panda suggested a Food Inflation and Response Strategy Team (FIRST), which can work with and across multiple key governmental agencies to proactively address food inflation. Assocham, SIAM, and Bengal Chamber of Commerce and Industry were among other industry associations that took part in the pre-budget consultations.

Earlier in the day, Sitharaman met with representatives in the financial and capital markets sectors who made suggestions on deepening the markets and fixing tax arbitrage wherever it exists. Arun Kohli, managing director of Morgan Stanley India Company, said they made suggestions towards stable tax policies and a long-term regime. Participants also made their points on capital gains tax and securities transaction tax. George Alexander Muthoot, MD of Muthoot Group, said some of the players pitched for deepening the market and providing some tax incentives. Non-banking financial companies (NBFCs) have also sought clarity on GST demand on co-lending and payment of GST on service fees, Raman Aggarwal, director at FIDC, said. “We’ve suggested that since NBFC credit has grown and RBI has flagged overdependence on banks, allocation of funds from Sidbi and Nabard could increase for refinancing of NBFCs,” Aggarwal said.

Indian Venture and Alternate Capital Association (IVCA) said that it made suggestions to mainstream AIF investments and encourage large domestic capital pools of insurance and pension funds to participate in the AIF industry to finance infrastructure, start-ups, scale-ups & growth companies.

[ad_2]

Source link