[ad_1]

Most seem to be grappling with the challenge of transitioning from GenAI proof-of-concepts (PoCs) to creating a revenue upside from these projects. “For many players working on GenAI projects, it’s an efficiency play now. There aren’t many use cases that demonstrate a revenue upside for GenAI projects. And when that happens, it would be the tipping point,” said LTIMindtree CEO & MD Debashis Chatterjee.

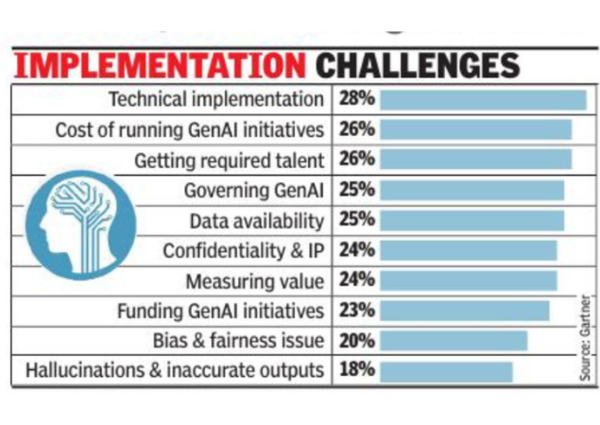

According to the Gartner AI in the Enterprise Survey, the cost of GenAI initiatives is mentioned as one of the top three barriers in implementing GenAI. “Organizations transitioning from GenAI pilots to production experience a rude awakening when it comes to costs. Creating a production-ready GenAI system can be orders of magnitude more expensive than running a pilot. Every token counts — strive to minimize costs across the AI life cycle,” wrote its analysts Arun Chandrasekaran, Leinar Ramos, Alberto Pietrobon, and Justin Tung.

Gartner, for instance, said its client-reported GenAI investments currently fall into the “defend” and “extend” categories. Most large enterprises run PoCs with multiple GenAI models providers, however, price, performance, and accuracy are key factors to avoid cost overruns.

A recent Lucidworks report said, despite initial hype, slow deployment and low success rates are commonplace, with only 25% of planned projects fully implemented. This lag is stalling anticipated ROI, with 42% of companies yet to see a significant benefit from generative AI initiatives. Additionally, concerns around response accuracy have risen fivefold, likely due to issues with hallucinations.

Former Cognizant president and chief strategy officer Malcolm Frank, in a recent post on Medium, asked if global service integrators (GSIs) are missing out on the AI revolution. He points to the valuation disconnect. “The GenAI age began in November of 2022 with the introduction of ChatGPT. Since then, Nvidia’s stock is up 736%, The magnificent seven (Facebook, Google, Amazon, Apple, Microsoft, NVIDIA, and Tesla) are up 279%, enterprise software leaders (SAP, Oracle, Salesforce, Workday, and ServiceNow) are up 159%. The top GSIs (i.e., Accenture, CapGemini, Infosys, DXC, Cognizant, and Wipro) are down 4%. Relative to the S&P 500 Index, this group has underperformed by 28%,” he wrote. “Minus 28%. Let that sink in for a moment. GSIs, despite a cumulative $10 billion in announced GenAI investments, have decoupled from the AI boom,” he said.

Frank said, looking at Copilot alone, Accenture has given it to tens of thousands of employees and claims 67% of developers use it daily. KPMG announced a $2 billion alliance with Microsoft. Cognizant now has 25,000 seats. And Infosys recently announced this as the “Age of Copilot.” “Yet for all this effort, there’s no recognizable revenue or margin lift. Additionally, clients now have POC fatigue, with many stating, ‘we’re being POC’ed to death,’” wrote Frank.

“One wonders if any IT services leaders will have the courage to chase Moore’s Law to its conclusion and radically change the headcount vs. software model. Eighteen months into the GenAI era, investors, clients, partners, and (most importantly) the 12 million employees in the industry are searching for a new model they can all bet on. It’s not here yet,” Frank wrote on Medium.

[ad_2]

Source link