[ad_1]

The 1,300 entities that purchased electoral bonds to make political donations potentially face questions from tax authorities on deductions that were made on these contributions with the Supreme Court having scrapped the scheme in February. A few companies have already received notices for deductions claimed for political contributions made through electoral bonds, people familiar with the development told ET.

Prominent companies such as Infosys, Embassy Group, Megha Engineering, Aditya Birla Group, JSW Steel, Torrent Pharma, Lupin, Intas, Bharti Airtel and Alembic Pharmaceuticals Ltd had purchased electoral bonds.

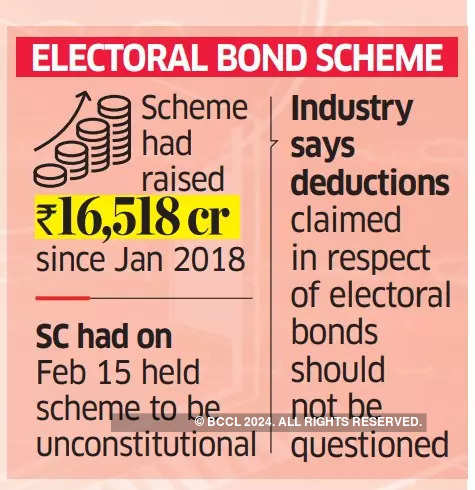

The Supreme Court had on February 15 held the electoral bond scheme to be unconstitutional. The scheme had raised ₹16,518 crore for political parties since it was notified in January 2018.

India Inc has flagged the matter to finance ministry seeking intervention, possibly in the upcoming budget.

‘Some may Move Court’

Industry has asked that deductions claimed in respect of electoral bonds should not be questioned.

“There is no clarity on political donations made through electoral bonds made up to February 15, the date of the Supreme Court decision,” said a person aware of the development. “There is the possibility of reopening of cases for past years for eligible claims.”

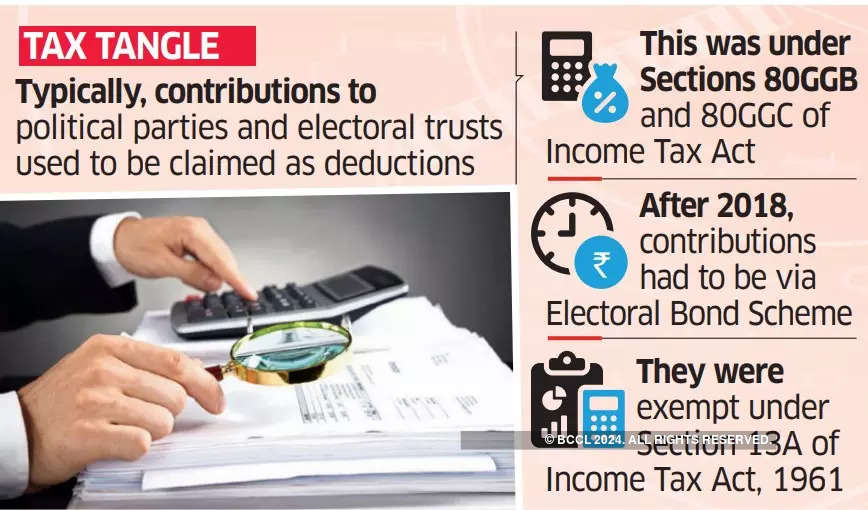

Typically, contributions to political parties and electoral trusts used to be claimed as deductions under Sections 80GGB and 80GGC of the Income Tax Act. Contributions after 2018 had to be made through the Electoral Bond Scheme, 2018. They were exempt from income tax under Section 13A of the Income Tax Act, 1961.

Tax experts say the decision has created a peculiar situation and needs to be clarified.

“Administrative instruction is needed to be issued clarifying that those who made contributions as per the scheme passed should not be subject to roving enquiries,” a tax expert said, adding that taxpayers could approach the court and file a writ.

[ad_2]

Source link