[ad_1]

On October 1, 2024, the National Financial Reporting Authority (NFRA), India’s independent audit watchdog, marked six years of its establishment. This period has been characterised by significant regulatory developments aimed at enhancing corporate financial reporting standards.

Established in the wake of a $2 billion fraud at Punjab National Bank in March 2018, NFRA was tasked with overseeing audit quality, stepping in where self-regulation by the Institute of Chartered Accountants of India (ICAI) had previously prevailed.

Overview of Debarment Trends

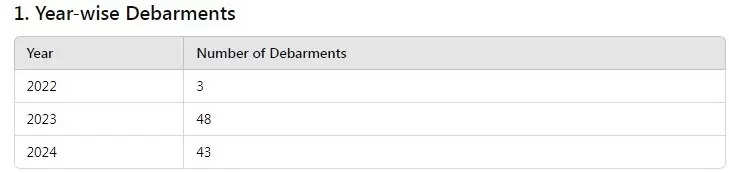

From June 21, 2022, to September 30, 2024, NFRA has made significant strides in regulating the auditing profession in India. During this period, a total of 94 orders have been issued to auditors, reflecting both the frequency and severity of penalties imposed.

Yearly Breakdown of DebarmentsIn 2022, NFRA recorded a notably low number of debarments, with only 3 cases identified from June to December. This limited activity can be attributed to the availability of data starting in June 2022. However, a marked change occurred in 2023, which saw a dramatic increase to 48 debarments. This surge indicates heightened scrutiny and intensified enforcement efforts, possibly in response to rising compliance issues within the sector.

By 2024, the number of debarments remained substantial at 43 cases, signalling a slight stabilisation compared to the previous year. This trend may suggest improved compliance among auditors, reflecting an evolving regulatory environment.

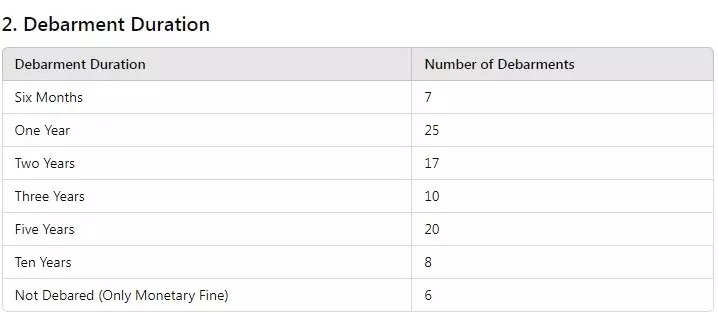

Duration and Severity of Debarments

An analysis of the duration of debarments reveals that the most common penalty was a one-year debarment, affecting 25 auditors. This suggests that many violations were viewed as moderate, warranting corrective actions without necessitating longer penalties. Conversely, a notable eight auditors faced ten-year debarments, underscoring the seriousness of their infractions and NFRA’s commitment to holding violators accountable.

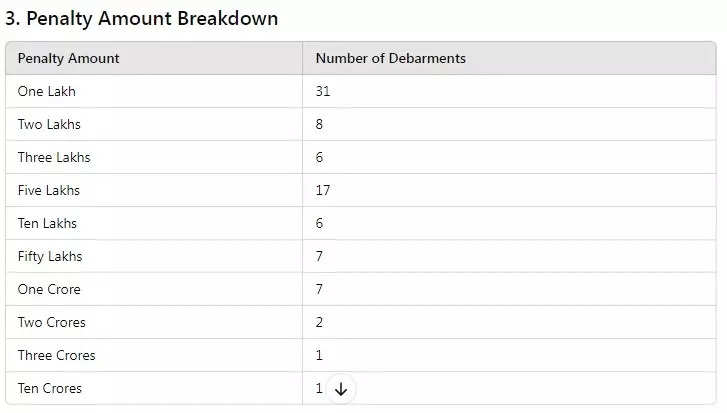

Penalty Amounts: A Closer Look

The majority of financial penalties imposed were set at Rs one lakh, with 31 instances recorded at this level. This indicates a standard infraction level faced by many auditors. However, higher penalties, including fines reaching Rs one crore, were imposed in a few severe cases, highlighting the presence of significant misconduct within the profession.

According to an NFRA officer, some orders, particularly those involving Deloitte and the IL&FS fraud, were stayed by court decisions, and further, due to the COVID-19 pandemic, NFRA had not issued much debarment orders in the initial four years. The website currently only reflects orders post-June 21, 2022. However, ETCFO has researched and gathered crucial orders issued by NFRA in its initial four years:

Udayen Sen, former CEO of Deloitte, was debarred for seven years in connection with the IL&FS fraud case.

Rukshad Daruwala and Shrenik Baid, both Deloitte partners, received five-year debarments related to the same case.

Auditor Jagdish Jham from Prabhu Steels was debarred for one year over professional misconduct.

Som Prakash Aggarwal, an auditor from Vikas WSP, faced a three-year debarment for similar violations.

Rajiv Bengali, a statutory auditor for Trilogic, received a one-year debarment for professional misconduct.

What Top Auditors of India Inc. Say at Six Years of NFRA

Sudhir Soni, Head of Audit, B S R & Co LLP, A KPMG Affiliate

“NFRA has taken significant steps towards strengthening audit quality through its orders and inspections. It has emphasised the importance of audit documentation to demonstrate compliance with auditing standards, which have the force of law and are not merely a set of principles. Additionally, there is a need to avoid conflicts of interest, both in spirit and perception. Audit firms and their networks are adopting strict policies on providing non-audit services to entities under NFRA supervision.”

We believe that NFRA’s actions and engagement with audit firms through inspections and conferences will provide clarity on their expectations. As these become clear, audit firms will be able to make necessary changes and adaptSudhir Soni, Head of Audit, B S R & Co LLP,

Vishesh C Chandiok, CEO, Grant Thornton Bharat

“There is pressure of reviews, particularly multiplicity of these for large firms—internal, global, PCAOB, peer review, and now NFRA. A regulator needs to be strict but should also show balance. While NFRA is working towards achieving such balance, I would request them to adopt a more remedial approach to help the profession enhance audit quality.”

The need for harmonization among various regulatory reviews is critical. It’s essential for the audit profession to feel supported in enhancing quality, rather than just facing sanctionsVishesh C Chandiok, CEO, Grant Thornton Bharat

Rajeev Saxena, Subject Matter Expert, S.N. Dhawan & Co. LLP

“The past six years have been transformative for the audit profession with the establishment of NFRA. As a relatively young regulatory body, NFRA has made significant progress in improving the quality and oversight of audits in India. It has established itself as a key player in enhancing transparency, accountability, and integrity in financial reporting.”

Looking ahead, NFRA must continue to engage closely with audit committees and boards, emphasizing their responsibilities in ensuring accurate financial reportingRajeev Saxena, Subject Matter Expert, S.N. Dhawan & Co. LLP

The Way Forward for NFRA

Looking ahead, several key areas for NFRA’s focus have been highlighted by auditors. Sudhir Soni emphasised the need for NFRA to strengthen its engagement with governance bodies, particularly audit committees and boards, stating that “increased interaction could significantly enhance the quality of financial reporting.

Rajeev Saxena noted the importance of fostering a culture of accountability among key managerial personnel and board members, stressing that “they must recognize their responsibility for maintaining accurate financial records and effective internal controls.

Vishesh C. Chandiok suggested that embracing technological advancements in auditing processes could improve efficiency and accuracy, stating that it could further elevate audit quality.

Chandiok advocated for adopting a more remedial approach to support auditors navigating the regulatory landscape, highlighting that such an approach would be vital for enhancing overall audit quality.

Soni pointed out that exploring settlement mechanisms could help avoid protracted litigation, allowing for quicker resolutions and creating a more constructive environment for compliance. By focusing on these areas, NFRA can continue to strengthen India’s financial reporting ecosystem and uphold investor trust.

[ad_2]

Source link