[ad_1]

Hyundai IPO: Hyundai Motor India (HMI), the second-largest passenger vehicle (PV) manufacturer in the country, is set to raise a substantial amount of capital through an offer for sale (OFS). The promoter, Hyundai Motor Company (HMC) of South Korea, will reduce its stake from 100% to 82.5% post the OFS. To comply with regulatory requirements, HMC will need to further dilute its stake to 75% or lower in the future, which may impact HMI’s stock price.

Hyundai IPO Analysis

HMI operates in a highly competitive market, and both Hyundai and its larger rival, Maruti, have experienced a gradual erosion of their volume market shares over the past five years.

Moreover, the IPO price does not provide significant valuation comfort compared to Maruti, which boasts nearly three times higher PV market share, two-and-a-half times higher sales volume, and similar profitability.

However, Hyundai has planned several new model launches in the coming quarters, spanning both internal combustion engine (ICE) and electric vehicle (EV) platforms. The company’s capacity expansion plans also bode well for future growth.

Considering these factors, risk-taking investors may find the IPO attractive, while risk-averse investors might prefer to observe the stock price trend post-IPO, says an ET analysis.

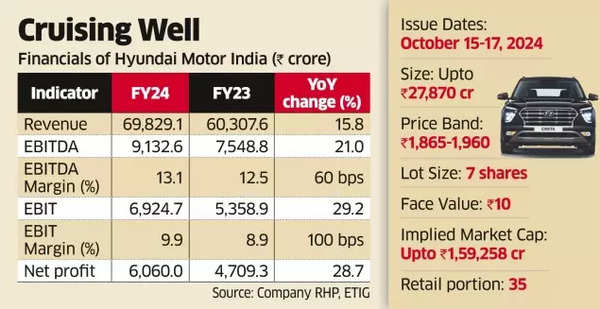

Hyundai IPO details

Established in 1996, HMI is a full-range manufacturer of PVs, including hatchbacks, sedans, and SUVs across various powertrains. The company operates a fully functional plant in Chennai with a capacity of 8,24,000 units and is currently setting up another plant in Talegaon, Maharashtra.

Also Read | Hyundai Motor India IPO, India’s largest IPO, set to open on October 15: From price band to listing – top 10 things to know

Once fully operational, the total capacity will reach 10,74,000 units over the next three to four years. In FY24, HMI’s PV sales grew by 8% year-on-year to 7,77,876 units, with ICE and CNG powertrains contributing 89.2% and 10.6%, respectively, while EVs accounted for 0.2%. The company’s market share in hatchbacks, sedans, and SUVs stood at 12.3%, 20%, and 18.4%, respectively, in FY24.

HMI’s revenue grew by 21.4% annually between FY22 and FY24, reaching Rs 69,829 crore, while net profit increased by 44.5% to Rs 6,060 crore. The company’s EBITDA margin improved from 11.6% to 13.1% during the same period, matching that of its peer, Maruti.

The intense competition in the market has led to a gradual decline in HMI’s PV market share, from 17.6% in FY20 to 14.6% in FY24. This may compel the company to offer higher customer discounts in the future to maintain market share, potentially impacting profitability.

HMI’s IPO price translates to an FY24 price-earnings (P/E) multiple of up to 26.7, while its closest peer, Maruti, trades at a P/E of 29.8.

[ad_2]

Source link