[ad_1]

Nearly 67% of the deposits mobilised by banks by the end of June 2024 were contracted at interest rates of 7% and above compared with 45% of deposits a year ago, latest central bank data showed, pointing to the higher returns lenders are now having to offer to garner deposits from savers to meet burgeoning credit demand.

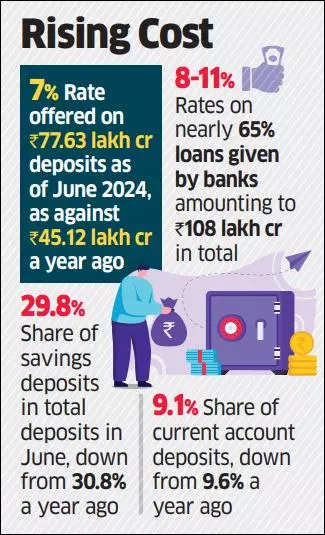

The latest Reserve Bank of India (RBI) data showed that banks offered interest rates above 7% on ₹77.63 lakh crore deposits as of June 2024, as against ₹45.12 lakh crore a year ago.

Central bank data also showed that nearly 65% of bank loans, amounting to ₹108 lakh crore in total, were given between 8% and 11%.

After being nudged by the banking regulator to narrow the gap between deposit and credit growth, banks began offering savers 7.5% to 8% on special deposit programmes. Still, credit continues to expand at more than 14%, while deposit growth is around 11%, indicating that banks cannot garner enough deposits to fund loan growth.

“The share of deposits with 7% interest rate rose because banks are offering higher rates not just to retail depositors but also mobilising bulk deposits and certificate of deposits over 7%,” said Madan Sabnavis, chief economist at Bank of Baroda.

“For a long time, post-Covid, most banks offered sub-7% on one-three years deposits. Also, to narrow the gap in credit-deposit growth, banks raised deposit rates to over 7%,” Sabnavis added.

The RBI data also showed that the weighted average lending rate rose marginally to 10.23% in June 2024, from 10.15% a year ago.

The share of savings deposits in total deposits fell to 29.8% in June 2024 from 30.8% a year ago. Share of current account deposits fell to 9.1% of total deposits in June 2024 from 9.6 per cent a year ago.

Net interest margins could come under pressure as banks will offer higher rates on deposits, but they are unable to charge higher rates to borrowers since the interest rates on government securities – which serves as a floor below which banks do not lend – have fallen, said a bank analyst.

[ad_2]

Source link