[ad_1]

Promoters continue to cash in on the market rally, with those of about 180 companies selling stock worth more than ₹40,000 crore through open market transactions in the September quarter so far, indicating that valuations are rich enough for owners to lock in gains on part of their equity holdings.

For the year to date, the value of shares sold by promoters via secondary market has already crossed ₹1 lakh crore. That’s more than twice in all of 2023, when the amount stood at ₹48,000 crore. In 2022 and 2021, the numbers were ₹25,400 crore and ₹54,500 crore, respectively.

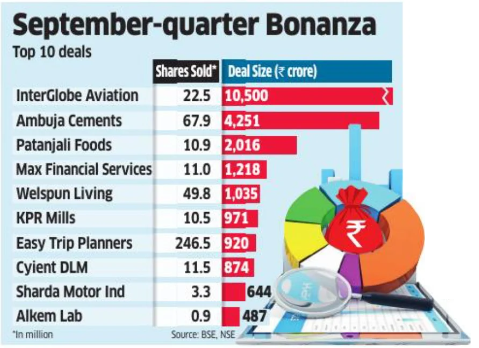

According to data from BSE and NSE, promoters of companies such as InterGlobe Aviation, Ambuja Cements, Patanjali Foods, Max Financial Services, KPR Mills, Easy Trip Planners, Welspun Living, Cyient DLM, Sharda Motor Industries, Cigniti Technologies, and Ethos have sold shares worth ₹300 crore to ₹10,500 crore since July 1.

Various Reasons

Market participants said promoters see the stock surge as an opportune moment and these are not red flags. Still, it’s something to keep in mind if a particular stock accounts for a substantial portion of an investor’s portfolio.

“With the market in a bull run, it’s pretty common for promoters to book profits as they likely see this as a good time to cash out, which explains the selling,” said Anand Rathi Wealth deputy CEO Feroze Azeez. “While the large-cap and small-cap indices seem reasonably priced, the mid-cap space has some amount of froth.”

Last month, InterGlobe Aviation promoter Rakesh Gangwal and his family trust sold a 5.83% stake for about ₹10,500 crore. In August, the Adanis sold about 2.8% of group company Ambuja Cements for ₹4,200 crore.

This month, promoters of Patanjali Foods sold 10.8 million shares for ₹2,016 crore. The promoter entity of Max Financial Services sold a 3.19% stake for ₹1,218 crore to repay its debt. Welspun Living’s promoter sold 49.8 million shares for ₹1,035 crore through an open market transaction.

KP Ramaswamy, one of the promoters of KPR Mill, sold shares worth ₹971.4 crore, while Nishant Pitti-co-founder and CEO of Easy Trip Planners-sold 24.65 crore shares through block deals for ₹920 crore on Wednesday.

These deals may have been prompted by the need to comply with listing norms, reduce debt or make room for strategic investments in the company, said experts. There are other reasons as well.

“When valuations rise, it’s common to see supply from the primary or secondary market, as promoters sell part of their stake for various reasons, such as diversifying businesses, setting up family offices, or engaging in philanthropy among others,” said Rajat Rajgarhia, managing director, institutional equities, Motilal Oswal Financial Services. “This trend is typical in mature markets, and India is no exception. Investors should not view this as a cause for concern.”

Indian markets have outperformed global peers and most foreign investors’ portfolios have been significantly overweight. The MSCI index has gained 26% so far this year, while the MSCI Emerging Market and MSCI World indices have rallied 11% and 17%, respectively.

[ad_2]

Source link