[ad_1]

Happy Wednesday! Peak XV Partners, formerly Sequoia Capital India, is cutting down the size of its 2022 fund by 16%. This and more in today’s ETtech Morning Dispatch.

Also in the letter:

■ IT Q2 preview

■ Oyo in legal tussle with Gujarat hotelier

■ Swiggy’s valuation markup

Programming note: ETtech Morning Dispatch newsletter will be off on October 2, on the occasion of Gandhi Jayanti. We will be back with a new edition on October 4. Stay tuned to ETtech.com for all the news and updates.

Peak XV downsizes its $2.85 billion fund by 16% a year after Sequoia US-India split

Peak XV Partners managing directorsVenture capital firm Peak XV Partners, formerly Sequoia Capital India, has pared the size of its $2.85 billion fund by 16% more than a year after it split from Silicon Valley-based investor Sequoia Capital.

Details: Peak XV’s eighth India and Southeast Asia-dedicated fund will see its corpus being cut by $465 million with the bulk of the reduction coming in its growth-stage.

Announced in 2022, Fund-VIII was supposed to utilise $2 billion across its India venture and growth investments, while the remaining was for deployment in Southeast Asian companies.

Also Read | Became too complex to run a global investment biz: Peak XV’s Shailendra Singh on Sequoia split

Fee changes: Besides resizing the fund, Peak XV is also restructuring the management fee it charges limited partners to 2% of the overall size of the fund with a 20% carry (on profits from exits) for its growth and multi-stage investments. The earlier fee was 2.5% fees and 30% carry for its growth and multi-stage funds.

However, a 30% carry will trigger if a given fund in the growth or multistage category achieves a 3x distribution to paid-in (DPI) capital – the measure of the total capital that a fund has returned to its limited partners (LPs) or sponsors of funds.

Caveat: While the fee changes, which are aimed at making the firm competitive with other risk capital investors, will be applicable for all the ongoing growth investments of Peak XV, there are no changes to the fee structures of the firm’s seed and early-stage investments.

Exits via public markets: In 2024, Peak XV has clocked over $1 billion in exits through sale of public stocks and private market secondaries, a person in the know said.

These include a $185 million stock sale from Indigo Paints, $150 million block deal in Five Star Business Finance, $73 million of liquidity through Mamaearth parent Honasa Consumer shares, and stake sale amounting to $40 million in Truecaller.

Also Read | Peak XV has Rs 16,000 crore for investment; AI to be in focus: Rajan Anandan

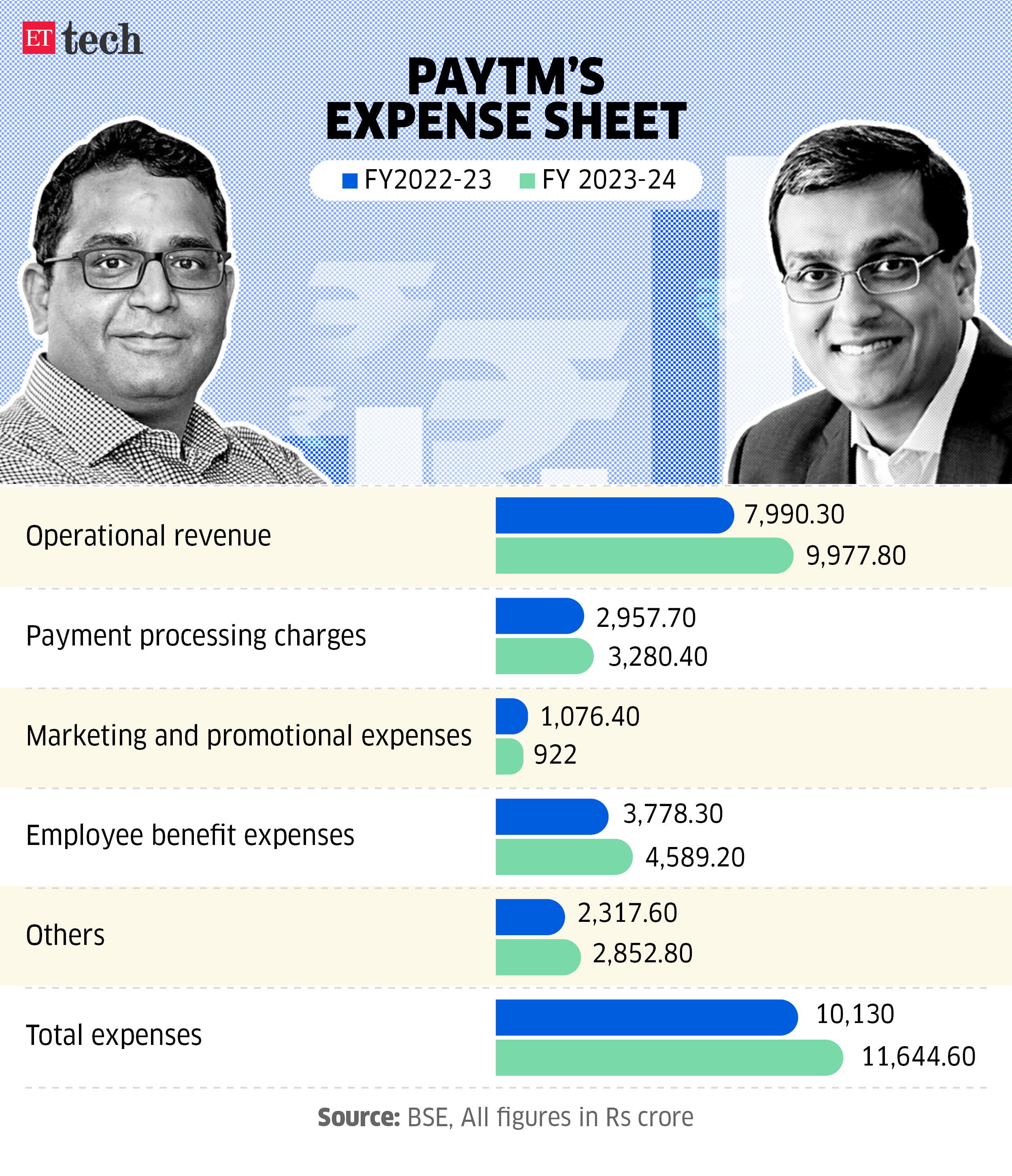

Paytm parent’s staff costs rise 21% in a challenging year

Vijay Shekhar Sharma & Madhur Deora

One 97 Communications Limited (OCL), which operates the digital payments platform Paytm, reported a 21% jump in employee costs and gave a significant jump in remuneration to its group chief financial officer (CFO), Madhur Deora.

Driving the news: In a board resolution adopted in September 2023, Paytm gave a 15% jump in remuneration to Madhur Deora and fixed it for three years till FY2026. This comes after Deora got a 9% hike in the previous year. Vijay Shekhar Sharma, the founder of Paytm, got his salary fixed in 2022 for three years till FY2025.

Understanding the numbers: Deora received a salary of Rs 3.6 crore, and his overall remuneration without his stocks in the company went up to Rs 4.2 crore in FY24. Sharma’s annual salary is at Rs 4.4 crore. The company saw its employee costs jump to Rs 4,589 crore in the last fiscal, but it has also committed to reducing it by Rs 400-500 crore in the current fiscal.

Big picture: Paytm has been going through a tough phase where its associate entity Paytm Payments Bank is under embargo from offering any banking services. The company slipped from its initial profitability targets and reported Rs 840 crore in net loss in June 2024 compared to Rs 358 crore last year.

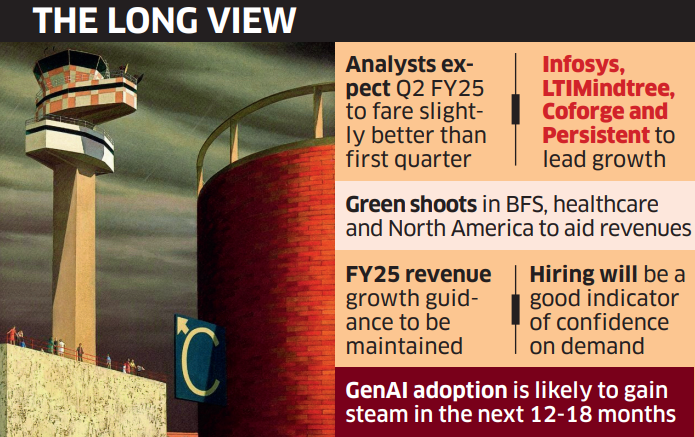

Big IT expects growth momentum to continue in September quarter

India’s software service providers will report their July-September quarter results in the coming week, and analysts expect them to be better than the first quarter on the back of deal revival and an improvement in business sentiment in North America.

Driving the news: Market leader Tata Consultancy Services (TCS) will kickstart the results season on October 10, followed by HCLTech on October 14. Infosys and Wipro will announce earnings on October 17.

Driving force: Green shoots in the banking and financial services sector in the Americas and a momentum in AI deals will hold the companies’ numbers.

“(The) IT sector may have slightly better Q2FY25 earnings, as we see increased momentum of hyper-scaler growth (AWS/Azure/Google Cloud), strong growth from North America after a lull, and momentum in healthcare,” ICICI Securities said in a report.

Also Read | IT’s fresher hiring may double in FY25 on demand rebound

Healthcare boom: Meanwhile, the healthcare business of the IT companies has been silently spearheading the $250 billion industry’s growth, being a bright spot at a time when key verticals such as financial services, retail and hi-tech have been under pressure for almost two years now.

Court comes down heavily on bailiff who sealed Oyo’s office; terms action illegal

Oyo CEO Ritesh Agarwal

SoftBank-backed Oyo’s registered office in Ahmedabad was sealed following a legal tussle with a Gujarat-based hotelier, a step against which the startup moved the city civil court.

What’s the news: The office was sealed on Monday in Ahmedabad following a warrant issued and executed in favour of a hotelier over non-payment of dues. However, the court said that the property sealed by the bailiff under the distress warrant was not permissible in law.

Granting relief to Oyo, the court said the distress warrant to execute the arbitration award was being recalled immediately and that the order for the warrant had been passed under the impression that the subjected award had attained finality. The court ordered the seal to be removed by 5 pm on Tuesday.

Fine print: “It is very strange that the bailiff of this court executed the warrant beyond the jurisdiction of this court and certain steps contrary to said warrant have been taken,” stated the order passed by Judge Manoj Bhailalbhai Kotak at the city civil court.

Also Read | Oyo projects three-fold rise in FY25 PAT at Rs 700 crore

Other Top Stories By Our Reporters

US investor Invesco raises fair value of Swiggy, reduces valuation of Pine Labs: A fund managed by US-based investor Invesco increased the fair value of public markets-bound online food delivery company Swiggy in its books to $13.3 billion as of July 31, according to a regulatory filing made with the US Securities and Exchange Commission.

BharatPe vs Ashneer Grover settlement: making sense of the legal battle between the two parties: On Monday, Gurugram-based fintech firm BharatPe settled all pending legal matters with its cofounder Ashneer Grover. The two parties had been in a protracted legal battle since 2022, when Grover and his wife Madhuri Jain were ousted from the company amid allegations of corporate governance lapses and misappropriation of funds.

NCLAT adjourns Byju’s case hearing to November 6: The Chennai bench of the National Company Law Appellate Tribunal (NCLAT) on Tuesday adjourned a case involving troubled edtech firm Byju’s and a group of its US lenders to November 6.

Global Picks We Are Reading

■ Microsoft’s Copilot AI gets a voice, vision, and a ‘hype man’ persona (Wired)

■ Telegram: a crypto firm with a sideline in messaging (FT)

■ Y Combinator faces heat after it backed an AI startup that admits it cloned another AI startup (TechCrunch)

[ad_2]

Source link